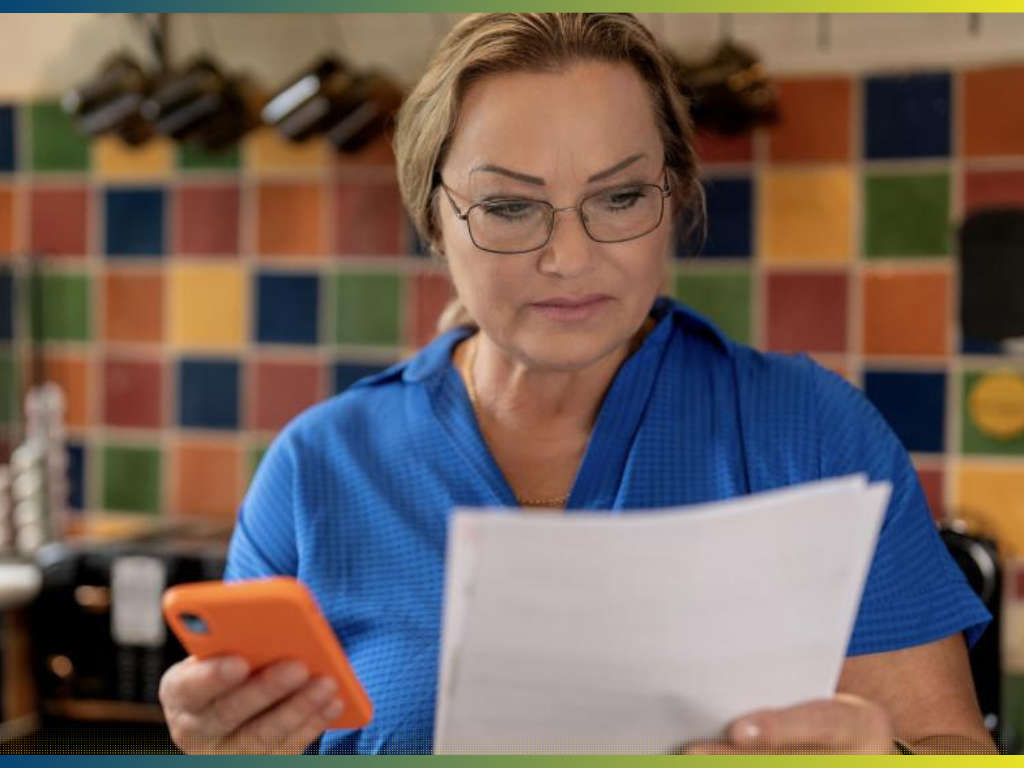

Reaching State Pension age can bring big financial changes. Most people stop paying National Insurance (NI), even if they continue working, and may be able to claim back overpaid NI or tax.

Even after pension age, you must submit a Self Assessment tax return for any year you work if you are self employed, but NI changes.

“If you’re self-employed, Class 2 contributions no longer count as paid, and Class 4 contributions stop from 6 April after you reach State Pension age,” explains HM Revenue and Customs (HMRC).

Read more here: State Pension Age how to stop paying NI and claim back tax | York Press

Wallace and Gromit and Friends Are Coming to the York Barbican!

Wallace and Gromit and Friends Are Coming to the York Barbican!

Whitby 24-Hour Adult Gaming Centre Approved on Appeal by Inspector

Whitby 24-Hour Adult Gaming Centre Approved on Appeal by Inspector

York Farm Shop in Pickering Named Finalist in Farmer Awards

York Farm Shop in Pickering Named Finalist in Farmer Awards

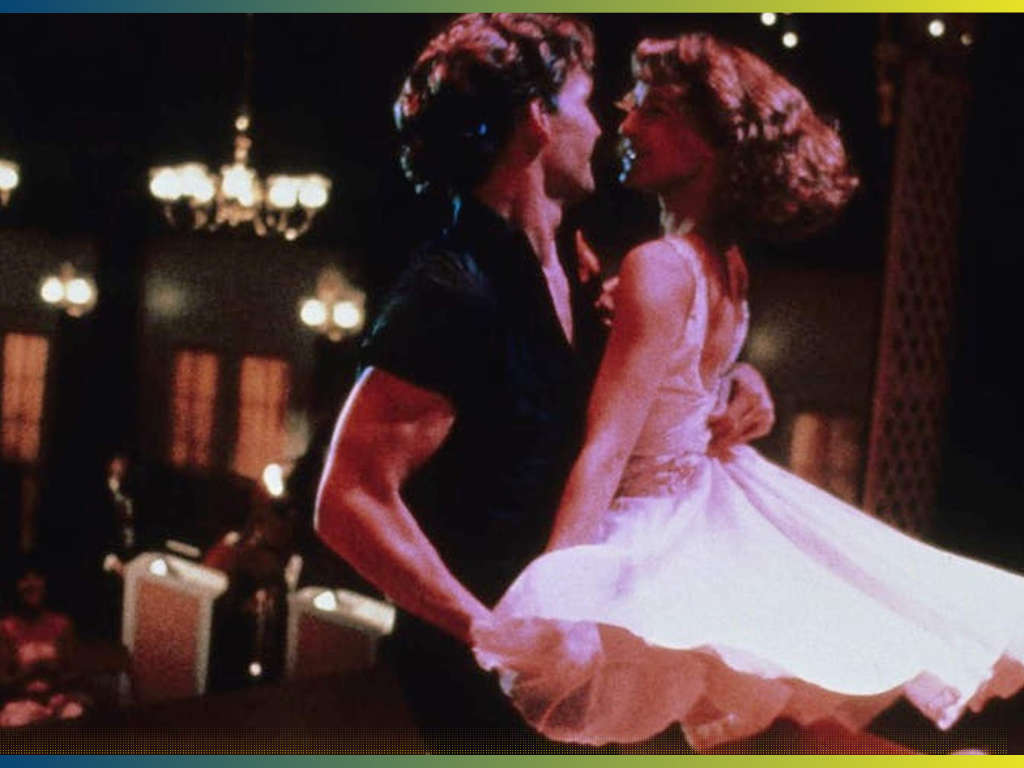

Dirty Dancing in Concert at York Barbican in May, 2026

Dirty Dancing in Concert at York Barbican in May, 2026

Ripon Grammar School Students Celebrate Oxbridge Places

Ripon Grammar School Students Celebrate Oxbridge Places

Harry Styles Themed LNER Train for Wembley Concerts

Harry Styles Themed LNER Train for Wembley Concerts

Gelato Lounge in Market Weighton Gets Zero Hygiene Rating

Gelato Lounge in Market Weighton Gets Zero Hygiene Rating

2026 Kirkbymoorside Gateway to the Moors Music Festival

2026 Kirkbymoorside Gateway to the Moors Music Festival